For SaaS companies, understanding financial health is critical, and one of the most important metrics in the mix is Monthly Recurring Revenue (MRR) growth rate. MRR gives you a clear view of how much predictable revenue your business is generating each month, while MRR growth rate shows how fast that revenue is increasing (or decreasing).

This post will walk you through how to calculate your MRR growth rate, why it’s one of the most important SaaS marketing KPIs, and the different methods to calculate it—complete with their pros, cons, and best-use cases.

By the end, you’ll have a solid understanding of how to track your MRR growth and can use our free MRR growth rate calculator to simplify the process.

Why MRR Growth Rate Matters for SaaS Companies

MRR growth rate provides a clear picture of your company’s momentum. Are you growing steadily, or has your growth stagnated? Here are three reasons why MRR growth rate is a must-track metric for any SaaS business:

- Predictable Revenue Stream: Unlike one-off sales, SaaS models rely on subscription revenue. Tracking MRR growth allows you to forecast future revenue more accurately, which is crucial for planning and scaling your business.

- Investor Appeal: Investors love MRR growth. A consistent upward trajectory indicates your product is gaining traction, making your company an attractive investment opportunity.

- Operational Efficiency: Monitoring growth in MRR can help you spot issues early—whether it’s negative customer churn or lackluster expansion—and address them before they impact your bottom line.

In short, tracking MRR growth rate helps you assess both short-term performance and long-term sustainability.

How to Calculate MRR Growth Rate

There are a few different ways to calculate MRR growth rate, each with its pros and cons. The formula you choose depends on what you’re trying to measure and how granular you want to be.

Basic MRR Growth Rate Formula

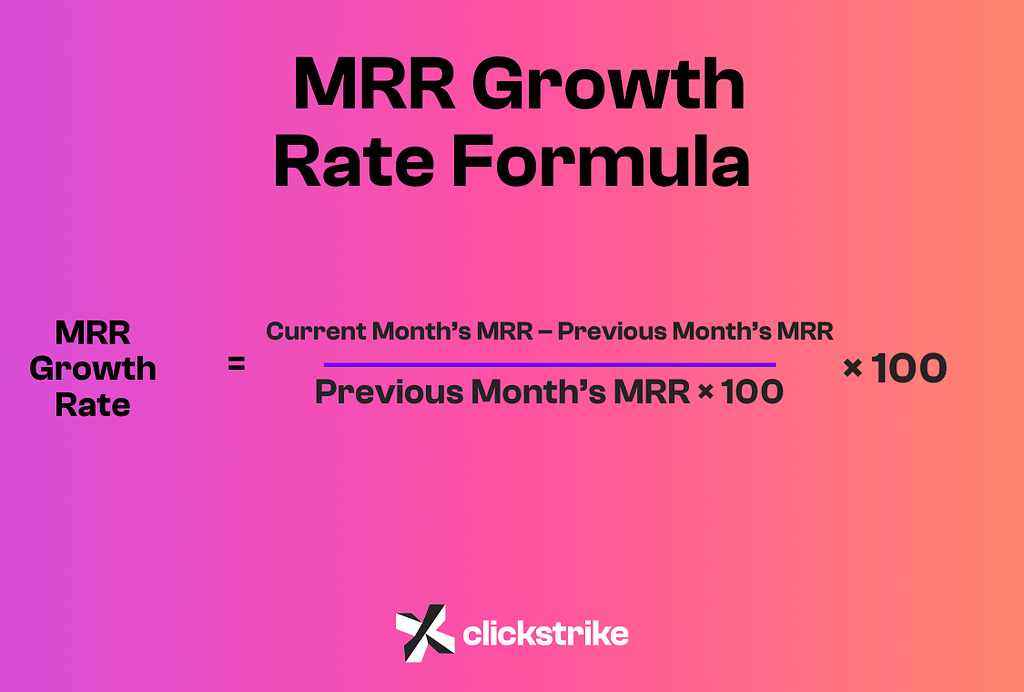

The most straightforward formula to calculate MRR growth rate is:

MRR Growth Rate = ((Current Month’s MRR – Previous Month’s MRR) / Previous Month’s MRR) × 100

For example, if your MRR last month was $10,000 and it’s $12,000 this month:

MRR Growth Rate = ((12,000 – 10,000) / 10,000) x 100 = 20%

This tells you that your MRR has grown by 20% month-over-month.

Alternative Methods of Calculating MRR Growth Rate

While the basic formula works for a quick overview, there are other ways to calculate MRR growth rate that can provide more nuanced insights into your business’s performance.

1. New MRR, Expansion MRR, and Churn MRR Method

This method breaks down MRR into more specific components:

- New MRR: Revenue from newly acquired customers.

- Expansion MRR: Additional revenue from upsells or cross-sells to existing customers.

- Churn MRR: Revenue lost due to customers canceling or downgrading.

The formula would look like this:

MRR Growth Rate = (New MRR + Expansion MRR – Churn MRR) / Previous Month’s MRR × 100

| Pros | Cons |

|---|---|

| Detailed insights into where growth is coming from (new customers, upsells, churn reduction). | Requires tracking of more metrics and can be complex for small startups. |

| Actionable data to tailor strategies for acquisition, retention, and upselling. | May require a more sophisticated analytics setup. |

Best Used When:

This method is ideal for more mature SaaS businesses that need to understand the nuances of their MRR growth and want to make data-driven decisions on customer acquisition, retention, and expansion strategies.

2. Cohort-Based MRR Growth Rate

Another method is to calculate MRR growth by looking at specific customer cohorts—groups of customers that share certain characteristics, like the month they subscribed.

MRR Growth Rate for Cohort X = (Current MRR for Cohort X – Original MRR for Cohort X) / Original MRR for Cohort X × 100

| Pros | Cons |

|---|---|

| Provides targeted analysis to see how specific groups of customers are contributing to growth. | More time-consuming and requires advanced analytics. |

| Helps track long-term retention and understand customer behavior over time. | More complex to implement and track over long periods. |

Best Used When:

This approach is useful when you’re interested in the long-term value and behavior of specific customer segments, helping you refine your acquisition and retention efforts.

Which MRR Growth Formula Should You Use?

- If you need a quick, high-level view of your growth, use the basic MRR growth rate formula. It’s simple, fast, and works well for companies at any stage.

- If you’re managing a more established SaaS company and want deeper insights into where growth is coming from, consider using the New/Expansion/Churn MRR method. This will help you fine-tune your strategies around customer acquisition, upselling, and reducing churn.

- If you’re looking for highly detailed, customer-segmented data to understand long-term trends, cohort-based analysis is a great option. It’s more advanced but provides incredibly valuable insights for scaling.

Conclusion

Calculating and understanding your MRR growth rate is crucial for running a successful SaaS business. It not only helps you track growth but also gives you insights into customer acquisition, retention, and expansion. By choosing the right formula for your business stage and goals, you can turn MRR growth rate into a powerful decision-making tool.

To make the calculation even easier, you can use our free MRR Growth Rate Calculator and start tracking your company’s growth with just a few clicks.

Tracking your MRR growth rate consistently will provide a roadmap for future success. Whether you’re aiming to attract investors, optimize your sales funnel, or improve customer retention, this metric is a critical part of your SaaS toolkit. Happy calculating!